How I have made over £15,000 from renting out my parking space

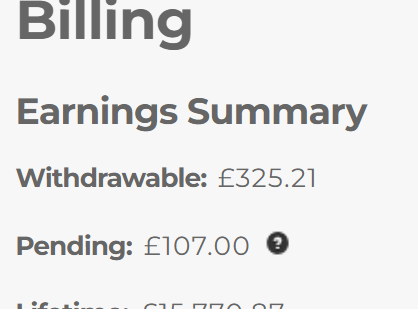

In July 2014, I wrote about how I earn money from JustPark, to rent out a space that lies empty on my drive. Back then I had earned £712 over a year, but that has increased and this is where I am today at £15,770 since I started in 2013.

The parking space has done so well that I decided to pave the tiny bit of overgrown weed-filled “lawn” next to it, put in proper drainage, and now also rent that out, so increasing my earning potential.

The paving over was expensive – £3,200 – but I will earn that back in under two years, so the investment is worth it.

If you are considering renting out your space, great locations are near stations, tube stops, town centres, airports, stadia and business parks. Parking around these areas isn’t cheap, so using JustPark can earn you money.

On the flip side, when in search of a parking space without wanting to pay NCP car parks charges, JustPark emerges as a fantastic alternative. Typically, parking spots secured through JustPark come at a price point that is only half of what is charged for the closest on-street alternative.

I set up my account in 2010, and got no bookings until May 2013. I used to charge £5.50 per day for my spot and JustPark takes a £1. This covers them advertising my spot, taking payment from the renter and basically providing me with a safe and anonymous feedback and communications platform. Communication is via their app, website and email, though my mobile is available for immediate queries. Today Just Park does dynamic pricing for me and I can earn £8.52 for a day’s parking, which seems reasonable for the location.

I have never met the renters as don’t feel the need to chat with them, and they have never asked to use my loo! The booking calendar makes it easy to mark any day as unavailable if I want to use the parking spaces for family, friends or workmen. It really is that easy.

Finally, when it comes to tax, ideally, if the income from property is less than £1,000, you are also able to enjoy it the fees tax-free and do not need to report it to HMRC. However, you can still take advantage of the £1,000 property allowance even if your income from property is more than £1,000 in a tax year. The allowance can be deducted from the income to arrive at the taxable profit. This is beneficial when actual expenses are less than £1,000.

Leave a Reply