Inheritance tax in the UK explained

If a beloved family member has recently passed away and you’re currently in the process of handling his/her inheritance, you’ll most likely be trying to get your head around the potentially thorny issue of inheritance tax (IHT), which is payable if the person’s estate is valued at an amount greater than the appropriate nil rate band allowance.

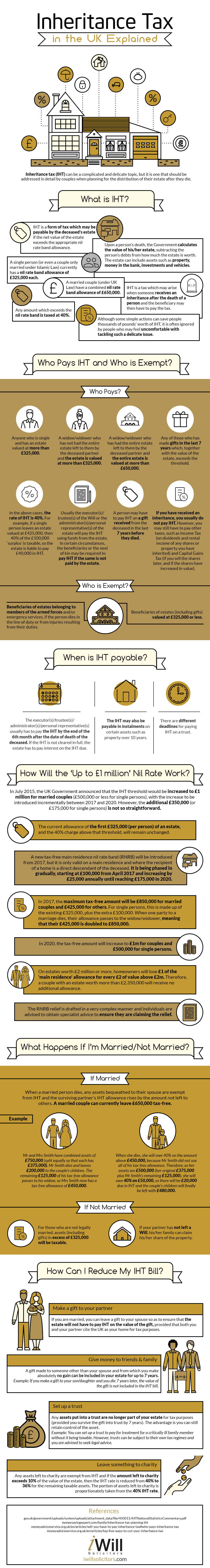

Birmingham-based legal experts I Will Solicitors have produced this highly educational and easy-to- understand infographic to explain all about the topic of inheritance tax. It outlines when you’d have to pay IHT, when you don’t, when payment is due,and what you need to know about the death of a married person.

There’s also a comprehensive explanation of how the government’s decision in 2015 to increase the nil band rate to £1 million for married couples (and £500,000 for single persons) by 2020 will work, in addition to some practical ways on how to potentially reduce the amount of IHT for which you may be liable.

If you have unanswered questions about IHT, the infographic below is hopefully going to give you the answer, so take a read through it to see how it can help you.

Leave a Reply